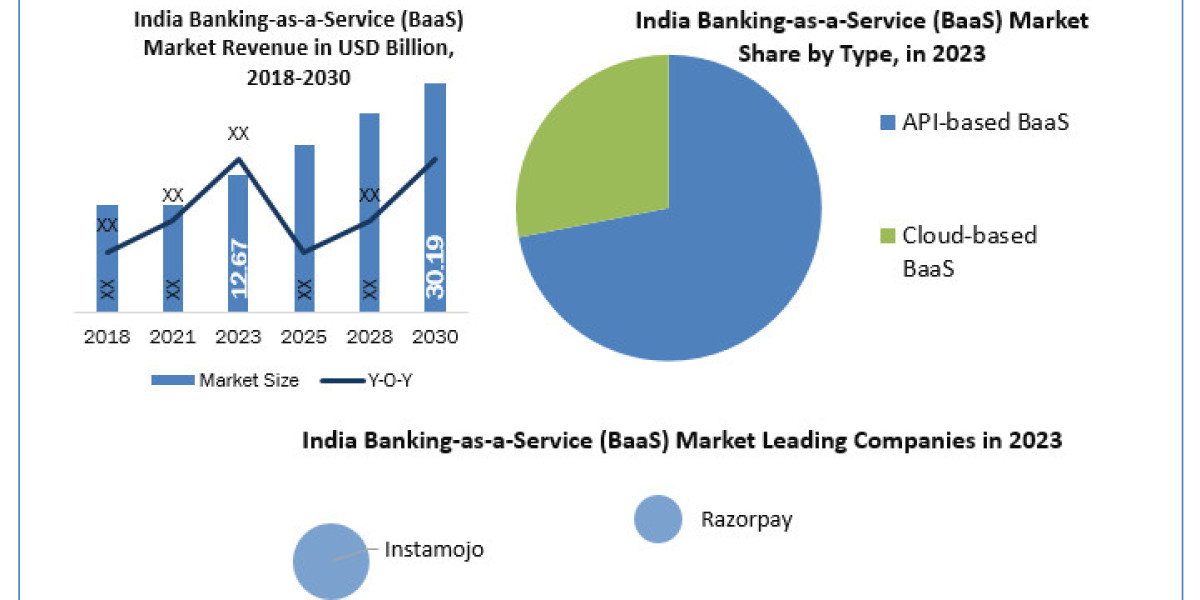

India Banking-as-a-Service (BaaS) Market size was valued at US$ 12.67 Billion in 2023 and the total India Banking-as-a-Service (BaaS) revenue is expected to grow at 13.2% through 2024 to 2030, reaching nearly US$ 30.19 Billion.

India Banking-as-a-Service (BaaS) Market Overview:

The Global India Banking-as-a-Service (BaaS) Market research provides a complete analysis of the market structure and competitive landscape. The India Banking-as-a-Service (BaaS) Market was thoroughly assessed using a bottom-up technique to understand market growth. The report's key insights include the primary market drivers at the global and regional levels, obstacles for future growth, and numerous opportunities created by technological improvements in the market.

Requst free sample:https://www.stellarmr.com/report/req_sample/India-Banking-as-a-Service--BaaS--Market/494

Market Scope:

Data for the analysis were gathered through primary and secondary research approaches. The report included both qualitative and quantitative analysis. Primary research was done to validate the secondary research findings. SWOT, PESTLE, and Porter's Five Force analysis were used to understand the variables influencing the growth of the India Banking-as-a-Service (BaaS) Market. Such analysis transforms the report into an investor's guide, assisting clients with investment and marketing selections. The India Banking-as-a-Service (BaaS) market is expected to develop over the forecast period. The India Banking-as-a-Service (BaaS) market is expected to witness significant growth. The research provides in depth analysis of business strategic approaches used by leading organizations which includes partnerships, mergers, acquisitions, and collaborative initiatives. The India Banking-as-a-Service (BaaS) report offers a detailed summary of major key players in the global India Banking-as-a-Service (BaaS) market. While analysing historical and future growth trends to provide a global perspective on the market, the report segments the India Banking-as-a-Service (BaaS) based on type, application, end users, and region.

Regional Analysis

Regional analysis is carried out to give information on market leaders in different regions, market penetration, and demographic factors influencing the regional Global India Banking-as-a-Service (BaaS) business. A competitive matrix is created for the India Banking-as-a-Service (BaaS) Market to encompass market leaders as well as new entrants. The study provides a summary of each organization and key takeaways based on revenue, technological improvements, recent developments, mergers and acquisitions, joint ventures, alliances, and marketing strategies. India Banking-as-a-Service (BaaS) is the fastest-growing region for food packaging, followed by ##. Increased disposable income, lifestyle changes, the growing popularity of packaged goods, and an increase in general consumer demand for canned foods are all factors contributing to regional expansion. The India Banking-as-a-Service (BaaS) # & India Banking-as-a-Service (BaaS) # regions are also showing significant growth during the forecast period.

India Banking-as-a-Service (BaaS) Market:https://www.stellarmr.com/report/India-Banking-as-a-Service--BaaS--Market/494

India Banking-as-a-Service (BaaS) Market Segmentation:

by Enterprise

SMEs

Large Enterprises

by Service

Banking IaaS

Banking as a Platform

FinTech SaaS

NBFCs

India Banking-as-a-Service (BaaS) market Key Players:

- Instamojo

- Razorpay

- Paytm

- Policybazaar

- Shiksha Finance

- PineLabs

- ZestMoney

Requst free sample:https://www.stellarmr.com/report/req_sample/India-Banking-as-a-Service--BaaS--Market/494

Key Questions answered in the India Banking-as-a-Service (BaaS) Market Report are:

- Which region held the largest market share in the India Banking-as-a-Service (BaaS) Market?

- What is the expected India Banking-as-a-Service (BaaS) market size by 2030?

- Which factors are the opportunities for the India Banking-as-a-Service (BaaS) market growth?

- What are investment opportunities for the India Banking-as-a-Service (BaaS) market?

- What are the recent industry trends that were implemented to generate additional revenue streams for the India Banking-as-a-Service (BaaS) Market?

- Which segment dominates the India Banking-as-a-Service (BaaS) Market?

For additional reports on related topics, visit our website:

Pentaerythritol Market: https://www.stellarmr.com/report/Pentaerythritol-Market/885

Soap Noodles Market: https://www.stellarmr.com/report/Soap-Noodles-Market/891

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include science and engineering, electronic components, industrial equipment, technology, and communication, cars, and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029