Resources for Auto Loan Information

Finding dependable information on auto loans could be difficult, which is where platforms like 베픽 come into play.

Resources for Auto Loan Information

Finding dependable information on auto loans could be difficult, which is where platforms like 베픽 come into play. The web site serves as a comprehensive resource for individuals excited about acquiring auto loans, offering detailed evaluations, comparisons of different lenders, and tips for securing the most effective ra

Additionally, these loans typically come with the convenience of reimbursement via payroll deductions. This association alleviates the stress of remembering due dates or processing funds manually, as the amount is automatically deducted from the employee's paych

One essential aspect of worker loans is that they can typically be tailored to the precise wants of the workforce. Companies might supply completely different quantities, reimbursement plans, and rates of interest to cater to various needs and circumstances. This flexibility could make a major distinction in staff' financial planning and stress administrat

Day laborer loans can even help build credit. While they could include greater interest rates, successfully repaying a loan can improve a borrower's credit score profile, opening doors to raised financial merchandise in the fut

After submitting your utility, the lender will evaluation your credit history and assess your monetary situation. In many instances, you'll find a way to receive a decision shortly, typically inside hours. If accredited, the funds will often be deposited immediately into your bank account, making it simple to entry the money when you want it m

Your credit rating plays a big function in determining your eligibility for an unsecured loan and the interest rates available to you. Higher credit score scores facilitate better loan terms, including decrease rates and more flexible reimbursement choices. Conversely, individuals with lower credit score scores may face rejection or receive loans with unfavorable phra

It's advisable to think about your purpose for borrowing and calculate how much you want versus how much you can afford to repay. This self-assessment helps avoid the trap of taking over more debt than you'll find a way to handle. Using online tools available on financial web sites can facilitate this process by offering accurate estimations of monthly funds and total costs associated with completely different mortgage quantit

How to Qualify for a Personal Loan

Qualifying for a private loan typically involves a evaluation of your credit historical past, earnings level, and existing debts. Lenders need to ensure that you've got the financial capacity to repay the loan you're requesting. Usually, a credit score rating of 600 or larger is seen as favorable, but some lenders would possibly accept lower scores depending on their insurance polic

When contemplating an Emergency Fund

Loan for Credit Card Holders, consider components such because the mortgage amount required, rates of interest, repayment terms, and any hidden fees. It's essential to shop around and compare completely different lenders to seek out the finest choice that matches your monetary scena

It’s essential to weigh the professionals and cons earlier than applying for a day laborer loan. On the positive aspect, they offer flexibility and immediate money availability. However, depending on the lender, interest rates may be greater than conventional loans, which necessitates cautious considerat

Before making use of, it’s a good idea to verify your credit report for inaccuracies or outstanding money owed that may negatively impression your rating. Additionally, gathering documents corresponding to income verification, employment historical past, and any existing monetary obligations will streamline the appliance proc

Types of Auto Loans

There are a quantity of kinds of auto loans, each catering to different wants and circumstances. The most common sorts embrace conventional auto loans, lease buyouts, and personal loans used for buying automobi

The Loan Application Process

Applying for an auto loan entails a quantity of simple steps. First, you want to assess your finances to find out how a lot you can afford to spend on month-to-month funds. This consists of contemplating loan amounts, term lengths, and what type of rate of interest you qualify

Additionally, employees already beneath monetary stress could find it difficult to speak their needs precisely, resulting in misunderstandings or mismanagement of the loan process. Because of this, ensuring a clear communication channel relating to phrases and expectations is vital for both eve

Potential Drawbacks of Personal Loans

While personal loans provide quite a few benefits, they aren't without drawbacks. One vital concern is the potential for top rates of interest, especially for individuals with less-than-perfect credit

Same Day Loan. If you're thought of a high-risk borrower, lenders could cost greater rates, which may result in more expensive overall compensation pri

Discover the Magic of an Overnight Desert Safari

By abhisheks08

Discover the Magic of an Overnight Desert Safari

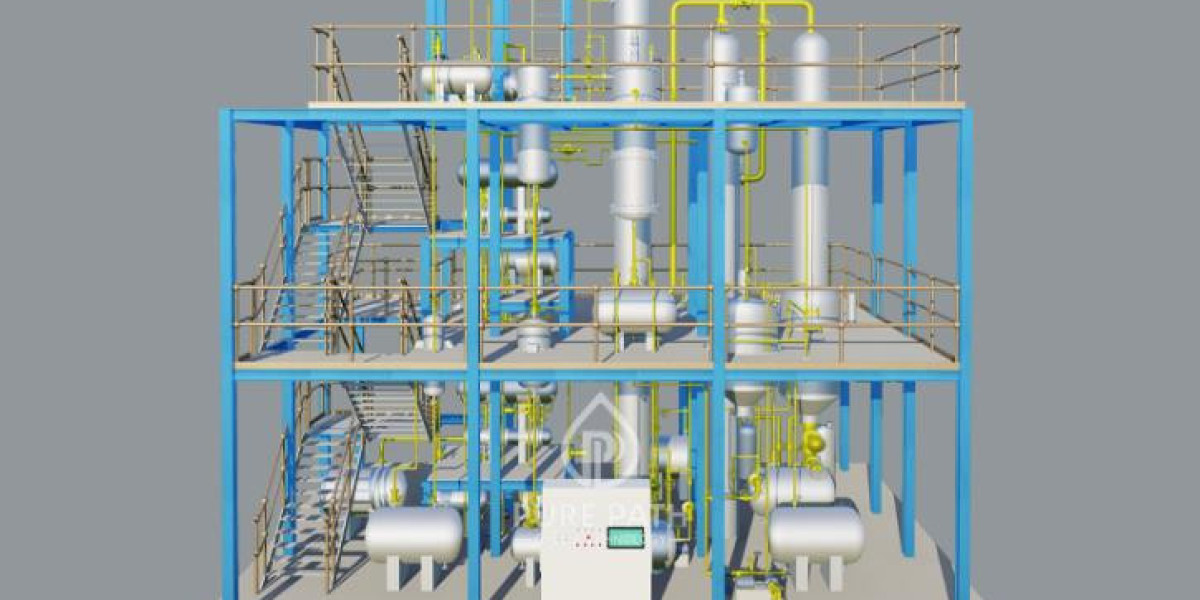

By abhisheks08 The Future of Renewable Energy: Innovations and Challenges

By qocsuing

The Future of Renewable Energy: Innovations and Challenges

By qocsuing Jalore Escorts To Enjoy Pleasure With Hot Call Girls

By kinu00

Jalore Escorts To Enjoy Pleasure With Hot Call Girls

By kinu00 300+ Bikaner Call Girls At Bikaner Escort Service, ₹ 4999

By kinu00

300+ Bikaner Call Girls At Bikaner Escort Service, ₹ 4999

By kinu00 Ajmer Escorts Service | With Room Near Hotel Royal Palace

By kinu00

Ajmer Escorts Service | With Room Near Hotel Royal Palace

By kinu00