Blockchain Insurance Company Overview

The blockchain insurance market is revolutionizing the way insurance transactions are conducted by leveraging distributed ledger technology (DLT) to create secure, transparent, and tamper-proof records. By enabling real-time data transfer and automating processes, blockchain technology streamlines operations and reduces costs. This innovation enhances efficiency, accelerates payouts, minimizes fraud, and improves customer satisfaction. As blockchain integration becomes more widespread, insurers can develop new models for market expansion, offering innovative products that were previously unfeasible. Blockchain also provides new opportunities for underinsured markets, particularly in developing countries, by lowering the cost of transactions and increasing competition.

Drivers in the Research Blockchain Insurance

The blockchain insurance market is primarily driven by the ability to streamline claims management and reduce fraud. Smart contracts, which automate the execution of contract terms, are increasingly being adopted to improve the speed and transparency of claims processing. This not only reduces the need for intermediaries but also enhances customer satisfaction by providing quicker pay-outs and greater certainty. Furthermore, blockchain’s immutable ledger ensures that data is accurate and tamper-resistant, which is crucial for preventing fraudulent claims. As the insurance industry faces mounting pressure to address fraud and inefficiencies, blockchain offers a promising solution to these persistent challenges.

Blockchain Insurance Company Opportunities

The blockchain insurance market presents significant growth opportunities, particularly in emerging markets where access to traditional insurance services is limited. By reducing transaction costs, blockchain enables insurers to offer products that were previously unaffordable or inaccessible. This opens up new avenues for insurance coverage in developing regions, allowing more people to access essential services such as health, auto, and property insurance. Moreover, the growing demand for digital solutions and the rise of tech-savvy consumers are driving the adoption of blockchain-based insurance products, creating new revenue streams and opportunities for innovation within the industry.

Get Your Free Sample Explore the Latest Company Insights: https://www.maximizemarketresearch.com/request-sample/12933/

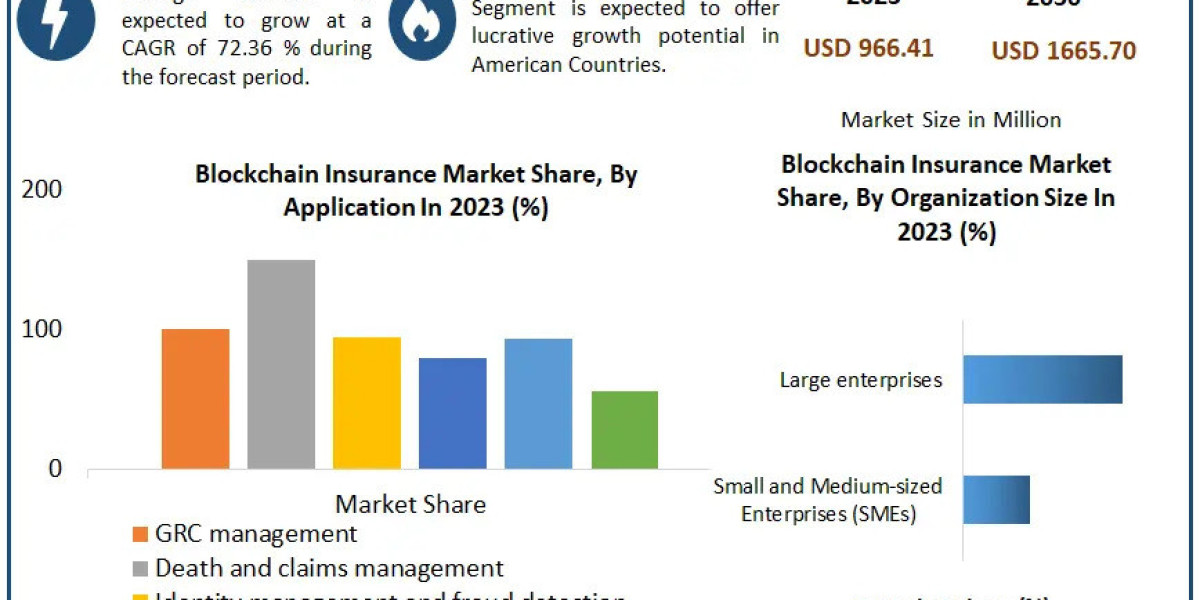

Segmentation Analysis of the Blockchain Insurance Company

by Provider

Application and solution provider

Middleware provider

Infrastructure and protocols provider

by Application

GRC management

Death and claims management

Identity management and fraud detection

Payments

Smart contracts

Others (content storage management and customer communication)

Blockchain Insurance Company Regional Analysis

North America is currently the dominant region in the blockchain insurance market, holding a significant share of the global market. The region's high adoption of blockchain technology, particularly in the finance and insurance sectors, has been a key driver of growth. Initiatives by leading insurance companies in the U.S. and Canada to integrate blockchain into their operations are helping to foster greater efficiency, transparency, and fraud prevention. Furthermore, the region’s well-established technological infrastructure, skilled workforce, and regulatory environment are fostering the continued expansion of blockchain in the insurance industry.

For More Detailed Visit: https://www.maximizemarketresearch.com/market-report/coating-resins-market/12933/

Who is the largest manufacturers of Blockchain Insurance Company worldwide?

North America:

1. Lemonade

2. MetLife

3. AXA XL

4. State Farm

5. Liberty Mutual

Europe:

1. B3i (Blockchain Insurance Company Initiative)

2. Allianz

3. Generali

4. Mapfre

5. Swiss Re

Asia-Pacific:

1. Ping An Insurance

2. Bajaj Allianz General Insurance

3. Sompo Japan Nipponkoa Insurance

4. Tokio Marine & Nichido Fire Insurance

5. QBE Insurance

Explore More: Visit Our Website for Additional Reports

♦ Global Osseointegration Implants Market

Table of Contents: Function as a Service companies:

- Overview of Function as a Service companies

- Epigenetics Carts: Global companies Status and Forecast by Regions

- Global companies Status and Forecast by Types

- Global companies Status and Forecast by Downstream companies

- companies Driving Factors Analysis

- companies Competition Status by Major Manufacturers

- Major Manufacturers Introduction and companies Data

- Upstream and Downstream companies Analysis

- Cost and Gross Margin Analysis

- companies Status Analysis

- companies Report Conclusion

- Epigenetics: Research Methodology and References

About Maximize Company Research

Maximize Company Research is a rapidly expanding market research and business consulting firm. We are trusted partners of numerous Fortune 500 companies, thanks to our ability to drive revenue growth through strategic, data-driven research initiatives. Our diverse portfolio spans multiple sectors, including healthcare, chemicals, food and beverage, IT and telecom, and aerospace and defense.

Contact Maximize Company Research

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

? sales@maximizemarketresearch.com

? www.maximizemarketresearch.com